mass tax connect estimated tax payment

PO Box 419540 Boston MA 02241-9540. Massachusetts Department of Revenue.

Massachusetts Income Tax H R Block

Learn What EY Can Do For You.

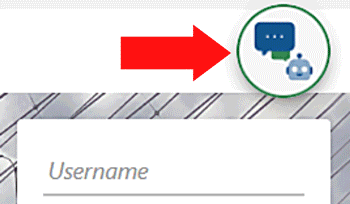

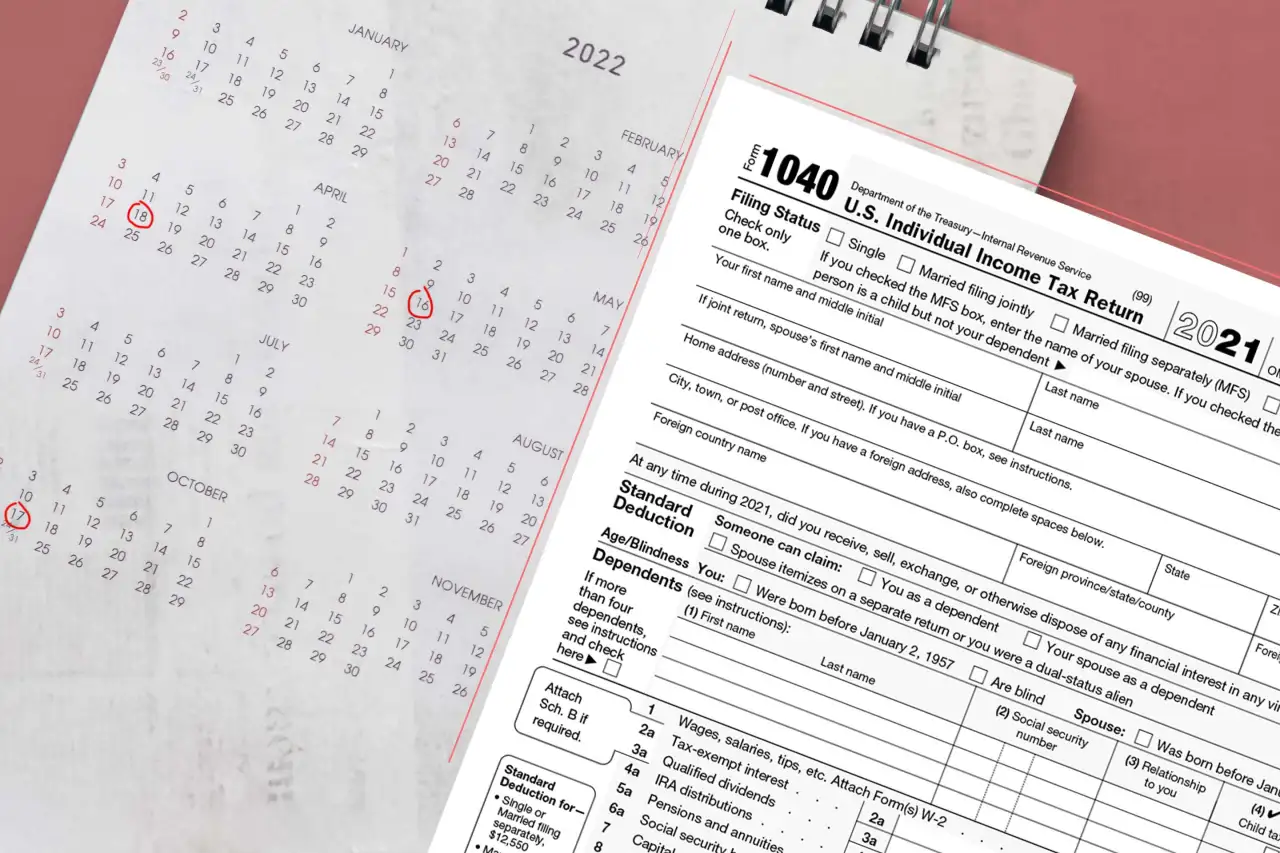

. With a MassTaxConnect account you can. Its fast easy and secure. The payment dates for Massachusetts estimated taxes are April 15 June 15 Sep.

Owners pay federal income tax on any profits minus federal allowances or deductions. 25 of estimated tax is due on or before September 15th. Please Enter 2020 Overypay Amount.

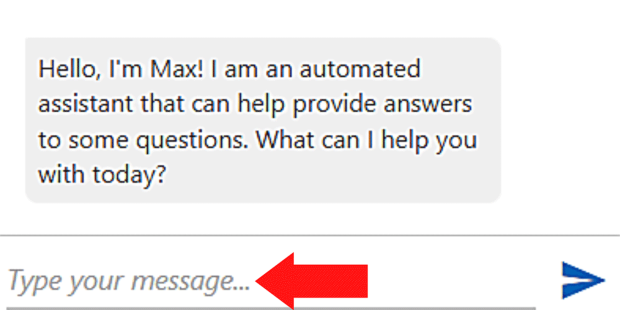

Estimated tax payments. 2020 overpayment applied to 2021 estimated tax. For more ways to communicate.

With estimated taxes you need to pay taxes quarterly based on how much you expect to make over the course of the year. Change or cancel payments previously scheduled through MassTaxConnect. On September 30 2021 the Massachusetts Legislature adopted an elective pass-through entity PTE excise in response to the 10000 cap on the federal state and local tax SALT deduction added in the 2017 federal Tax Cuts and Jobs Act.

Our goal is to help those practice owners decide whether to move forward with the Entity Level Tax for 2021 get them set up to make those payments through Mass Tax Connect and then initiate the tax payment prior to 123121. We help users connect with relevant financial advisors. Individuals and businesses can make estimated tax payments electronically through.

We plan to reach out to eligible practice owners soon about this tax savings opportunity. Some LLCs pay Massachusetts sales tax on products. 617 887-6367 or 800 392-6089 toll-free in Massachusetts Visit Contact DOR for more ways to connect with DOR.

Questions about estimated payments For more information see DOR Estimated Tax Payment. Your Tax Amount is Less Than 400. IRS approved e-file provider.

Contact Center hours are 9 am. The most significant taxes in Massachusetts are the sales and income taxes both of which consist of a flat rate paid by residents statewide. Go to massgovmasstaxconnect for more information.

Make bill payments return payments estimated tax payments and extension payments from a bank account or using a credit card. Please Select When Your First Voucher was Due 000. You Do Not Need To Make Estimated Payments.

Massachusetts joins several other states in enacting an entity-level excise that responds to the SALT cap. Massachusetts Department of Revenue. Scalable Tax Services and Solutions from EY.

Corporate estimated tax installments are due as follows. Confirm the payment request information. Ad Corporate Tax Tools and Services to Help Businesses Meet Global Tax Transformation.

Owners pay self-employment tax on business profits. The statewide sales tax rate of 625 is among the 20 lowest in the country when including the local taxes collected in many other states. The portal allows users to file and amend returns view balances make payments view correspondence register new accounts update information submit documents and applications and more.

Keep the payment confirmation for your records. Paid in four installments according to the schedule below. Click to use Granite Tax Connect now.

The agencys new online portal to manage accounts for taxpayers tax professionals and other DRA customers. 4 pm Monday through Friday. Instead taxes are as follows.

Owners pay state income tax on any profits minus state allowances or deductions. Use the Massachusetts Adjustments section for Screen 71 2022 Estimates 1040-ES to adjust the estimated tax calculation for Massachusetts. We Help Taxpayers Get Relief From IRS Back Taxes.

800 392-6089 toll-free in Massachusetts You may also connect with DOR with MassTaxConnect by email or in person. Ad Honest Fast Help - A BBB Rated. See Entering estimated tax on a multi-state individual return for more information.

Under Payment Type select Estimated payment. Make your estimated tax payment online. Download or print the 2021 Massachusetts Form 1-ES Estimated Income Tax Payment Vouchers for FREE from the Massachusetts Department of Revenue.

The MA DOR has published a FAQ related to the new tax and has made several. Download or print the 2021 Massachusetts Form 355-ES Corporate Estimated Tax Payment Vouchers for FREE from the Massachusetts Department of Revenue. As of November 30 2021 MassTaxConnect the states online tax payment portal is allowing taxpayers to make estimated tax payments for 2021 80 of the ultimate tax liability is required to be paid by January 15 th otherwise underpayment penalties will apply.

Ad See If You Qualify For IRS Fresh Start Program. The Massachusetts income tax rate is 500. Welcome to MassTaxConnect the Massachusetts Department of Revenues web-based application for filing and paying taxes in the Commonwealth.

Submit and amend most tax returns. Ad Use Our Free Powerful Software to Estimate Your Taxes. Free Case Review Begin Online.

Start wNo Money Down 100 Back Guarantee. 40 of estimated tax is due on or before March 15th. 25 of estimated tax is due on or before June 15th.

Access account information 24 hours a day 7 days a week. Total Payment Remaining For This Year.

Opt In And Contribute To Paid Family And Medical Leave As A Self Employed Individual Mass Gov

美國報稅 美國買房與自住房不能錯過的8項稅務優惠 省稅 節稅 Tax Refund Income Tax Brackets Estimated Tax Payments

A Guide To Estate Taxes Mass Gov

Mobile Concept Tax Prep For The Modern Worker Tax Prep Tax App Mobile App Design

Massachusetts Sales Tax Guide And Calculator 2022 Taxjar

2021 Personal Income And Corporate Excise Tax Law Changes Mass Gov

Tax Guide For Pass Through Entities Mass Gov

Masstaxconnect Resources Mass Gov

When Are Taxes Due In 2022 Here Are All The Major Deadlines Money

Massachusetts Tax Rates Rankings Ma State Taxes Tax Foundation

Prepare And E File Your 2021 2022 Ma Income Tax Return

Masstaxconnect Resources Mass Gov

2022 Filing Taxes Guide Everything You Need To Know

Massachusetts Sales Tax Small Business Guide Truic

Massachusetts Tax Rates Rankings Ma State Taxes Tax Foundation